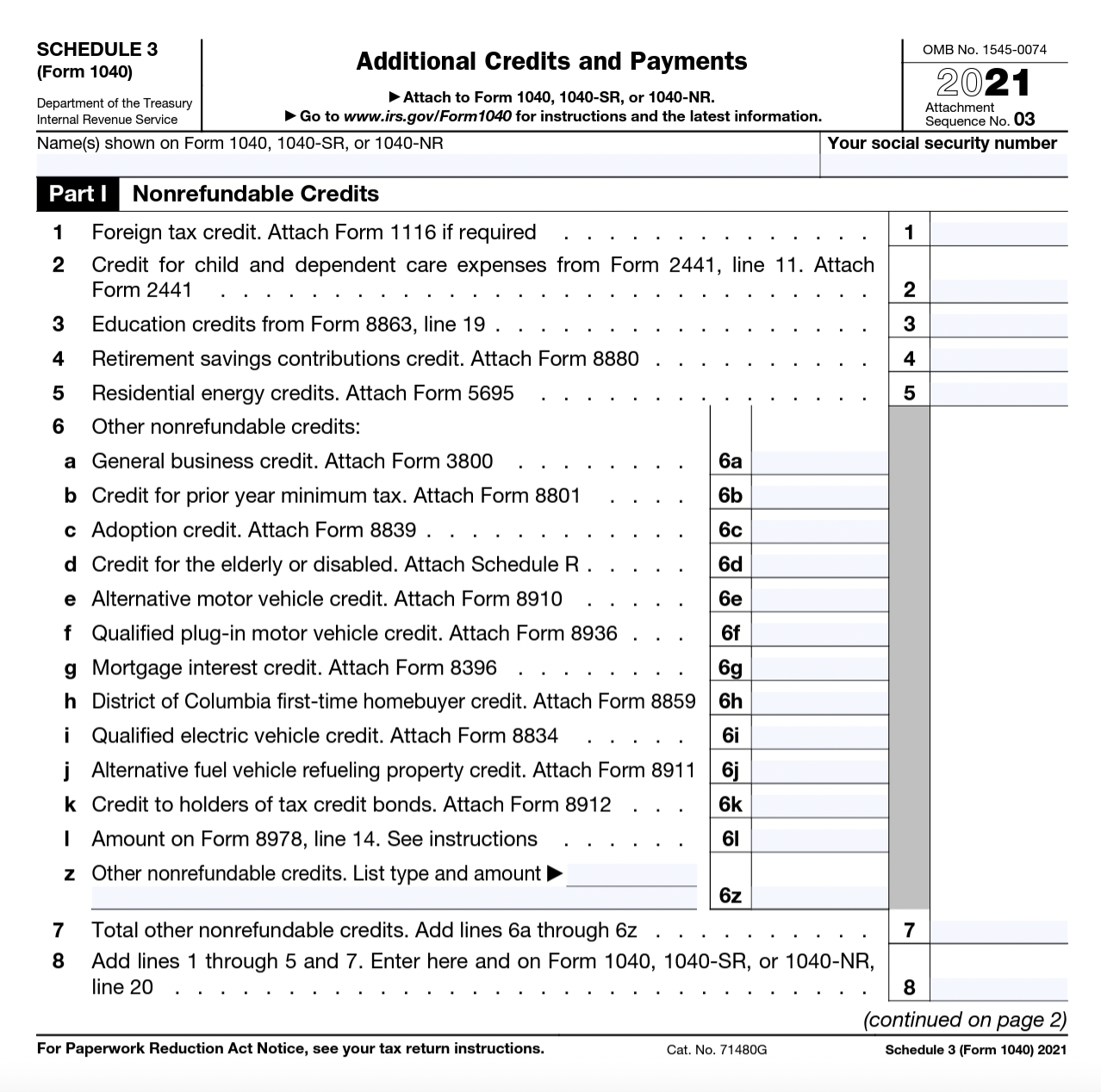

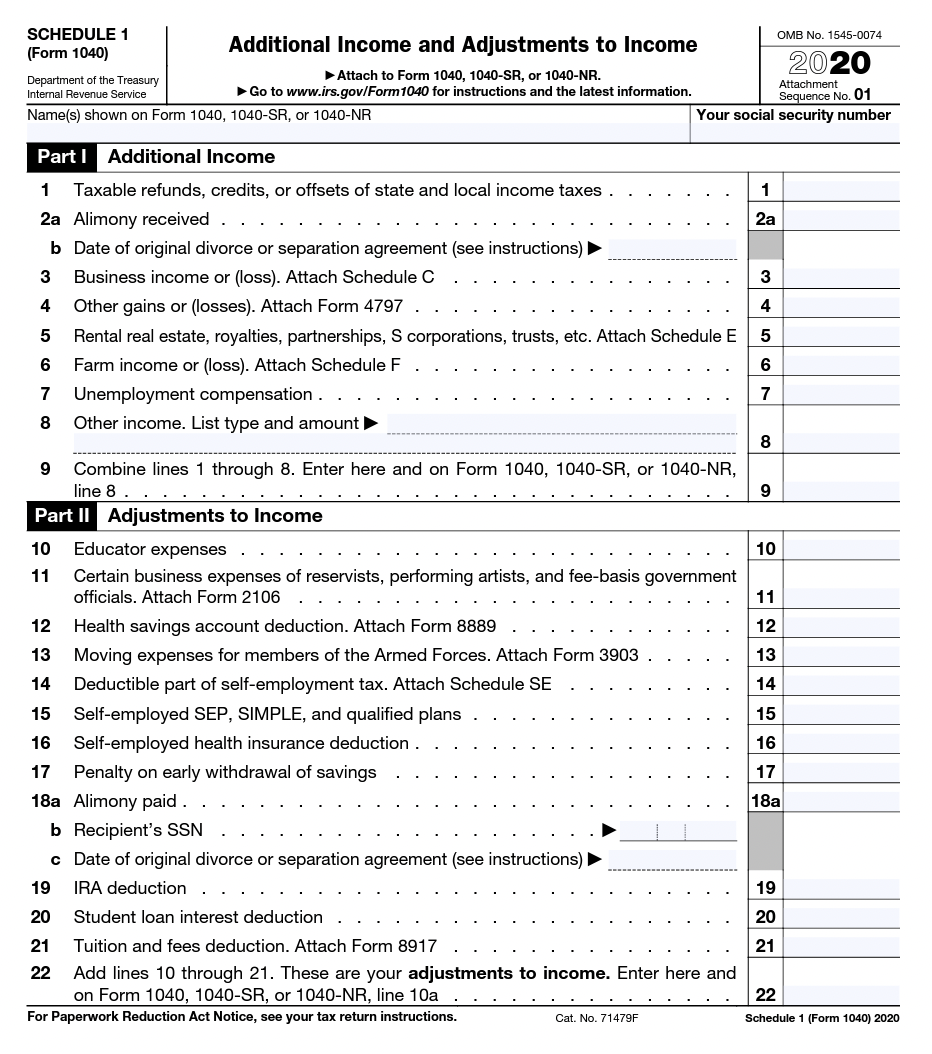

Irs 1040 Schedule A 2024 – Schedule A (Form 1040 or 1040-SR): Itemized Deductions is it is $20,800. For the tax year 2024, the standard deduction for single taxpayers and married couples filing separately is $14,600. . The latest annual inflation adjustments report from the Internal Revenue Service (IRS) reveals modifications to income tax brackets and standard deductions for the upcoming 2024-2025 tax season. .

Irs 1040 Schedule A 2024

Source : carta.com

Form 1040 for IRS 2023 2024 ~ What is it? Schedule A B C D

Source : www.incometaxgujarat.org

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

IRS moves forward with free e filing system in pilot program to

Source : www.sandiegouniontribune.com

IRS moves forward with free e filing system in pilot program to

Source : www.columbian.com

Most commonly requested tax forms | Tuition | ASU

Source : tuition.asu.edu

IRS to Launch Free E Filing Program in 2024. Here’s What to Know

Source : www.nbcboston.com

Most commonly requested tax forms | Tuition | ASU

Source : tuition.asu.edu

Tax Forms For 2024 Tax Returns Due in 2025. Tax Calculator

Source : www.efile.com

Form 1040 for IRS 2023 2024 ~ What is it? Schedule A B C D

Source : www.incometaxgujarat.org

Irs 1040 Schedule A 2024 Business tax deadlines 2024: Corporations and LLCs | Carta: The IRS again delays law that would have required Ticketmaster, Venmo, and others to issue 1099-Ks to those with more than $600 in revenue in 2023. . That could provide a break to some taxpayers on their taxes in 2024. The tax agency on Thursday said it’s adjusting the tax brackets upwards by 5.4%, relying on a formula based on the consumer .